This week, we’ll walk through:

- the Category Assessment Results from last week’s evaluation (Part 3).

- Part 4 of the Evaluation: Analyzing Your Tactics to Turn Data Into Action.

For the past 3 weeks I’ve been blogging about Retailer strengths and opportunities in connection with their overall retail strategy, category management approach and category assessment. The blogs have each included a survey – as part of an overall category management scorecard – and each survey part helps identify the biggest improvement areas for Retailers.

Here are links to the past 3 blogs (in case you missed them):

Part 2: Category Management Approach and Process

CATEGORY ASSESSMENT RESULTS SUMMARY

Category assessment scores were higher overall than the past two week’s topics on “Retail Strategy” and “Category Management Approach”, indicating the ability for many Retailers to effectively analyze data. While Retailers may be good at analyzing and using data, their analytics are most likely limited because they lack defined strategies and processes required for effective category management (as we uncovered in “part 1” and “part 2” of this blog series).

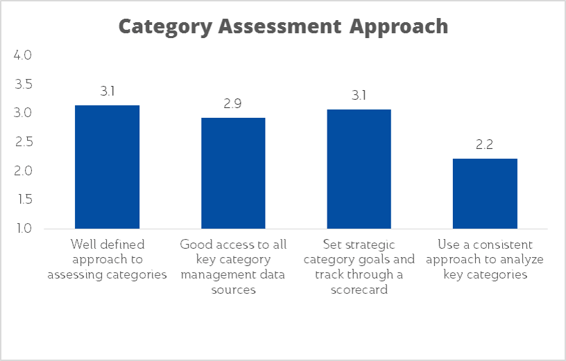

Last week’s survey asked for self-reported ratings across different areas that should be included in your overall category management approach. The scale was (1 = weak to no understanding; 5 = strong understanding).

Topline Results

- Overall Approach to Category Assessments. In general, Retailers scored “medium” on their category assessment approach and strategies, with a 2.9 on “good access to key category management data sources”.

- Of note, “using a consistent approach to analyze key categories” was rated much lower at 2.2, indicating that consistency to category assessments is an opportunity area.

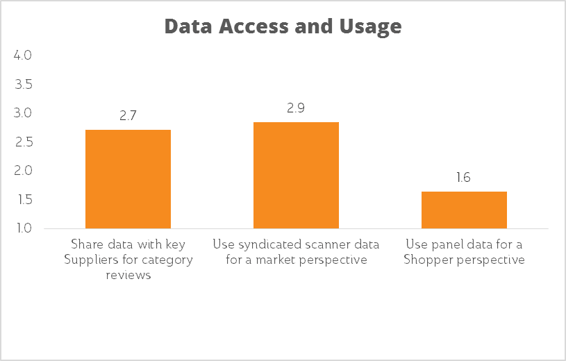

- Data Access and Usage. Access to key data sources – including scanned sales, market and consumer data are required to complete an effective category assessment from different perspectives. While there is “medium” usage of syndicated scanner data by Retailers to benchmark their category results to total market, there’s “weak” usage of consumer panel data. This is an important opportunity to note, because panel data gives a consumer perspective that for many small- to mid-sized Retailers may be one of their only Shopper-focused data sources.

- Another common practice throughout category management in retail is for Retailers to share their data with key Suppliers/Manufacturers who can provide resources and category expertise to help drive category sales. Sharing data can also help Retailers make better decisions for their categories. This practice was rated “medium” at 2.7, indicating that many Retailers do not share data with their Suppliers/Manufacturers.

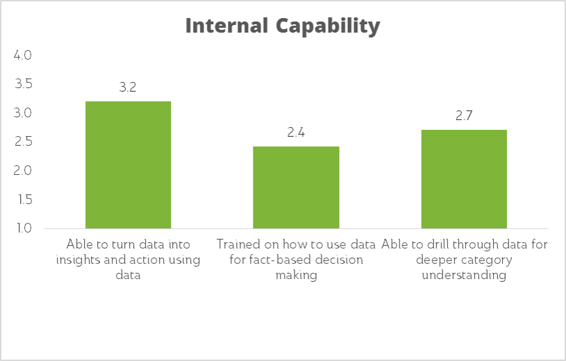

- Internal Capability. In the past, Retailers have relied heavily on Suppliers/ Manufacturers to provide much of the data and analysis in the category, but Retailers now have a big opportunity to arm their team with the strategic and analytic skills to make fact-based decisions that align to the overall strategies and processes of their organization. They will still rely on Suppliers/Manufacturers for some of the data and analytics, but will understand the data, analytics and strategic implications of the recommendations and decisions that are made. This understanding will then help them achieve their overall category targets.

- While survey participants rated a 3.2 “medium” on their ability to turn data into insights and action and a 2.7 “low medium” on their ability to drill through data, they scored much lower as it related to the training they get (or have received) to help them make more strategic, fact-based decisions. This is consistent with the last survey where participants noted the need for more training as it related to overall category management process and retail strategy.

Participant Comments

The survey also asked for written feedback on the biggest opportunities for Retailers regarding “Category Assessment”.

“For a small Retailer, access to data can be challenging, and where it does exist we often can’t offer the level of compensation required to attract employees with the necessary skill sets. Much of the time we’re building tools from the ground up, working with very limited resources.”

“We need to learn how to more strategically use data as a resource to help guide our decision-making.”

“We are proficient at analyzing data but don’t tie it back to overall strategies for the organization. This makes us strategic in some categories but not as an aligned organization.”

SURVEY PART 4 of 5:

UNDERSTANDING & ANALYZING THE TACTICS

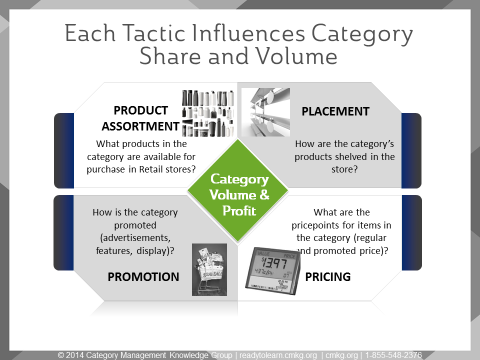

The category tactics, or 4 Ps, include Product, Placement, Pricing and Promotion. Each of the tactics influences volume and share within a category. They are the key drivers that need to be monitored to understand how each impacts volume growth or decline within a category. Some tactics may have a bigger influence in one category over another.

Retail category management teams need to have strong analytic skills to assess each tactic and ensure that the decisions that they make for that tactic will meet Shopper needs, and ultimately, help them achieve their goals & objectives for the category.

To truly understand and analyze the tactics, you need to consider the following:

- Which tactics have the largest influence on volume and share in the category?

- What are the most important Shopper needs when making tactical decisions?

- How effective are the principles and guidelines that are in place for each tactic to help you make the best decisions for your categories (as part of your overall Retail strategy)?

- How do you analyze each tactic to ensure your decisions for each align to your target Shopper needs?

- How strong are your analytic and strategic thinking skills as they relate to each of the tactics?

How does your organization score on the 4 Ps?

Find out now with Part 4 of our Category Management Scorecard focused on the Tactics.