Integrating strategy into your analytics is one of the main areas most struggle with when doing their analytics — knowing what's relevant and what's not, what's a true insight and what's not. But if you know the secret sauce to bringing strategy into your analytics you’ll be able to turn your data and analysis into effective action to grow your business. And so I want to talk about pizza. Yes, you read that right — pizza.

The Crust — Your Strategies and Goals

So when you think about a pizza, there are three different elements. The first element is the crust, which represents the strategies and goals associated with what it is that you're trying to accomplish. To start, you really need to be clear about what your company is trying to accomplish; sometimes I ask people what the overall goals and objectives for their organization are and they're not really sure. You need to understand your organizational or overarching strategies or objectives for your company and what you're trying to achieve in terms of overall business results, how you're going to get there, and the areas to focus on that need improvement.

If you call on retail customers, you need to understand their overall goals and objectives as well. You're going to have a very hard time finding compelling insights about their business if you don’t understand what their overall strategies and best practices are and what the retail customer is trying to accomplish.

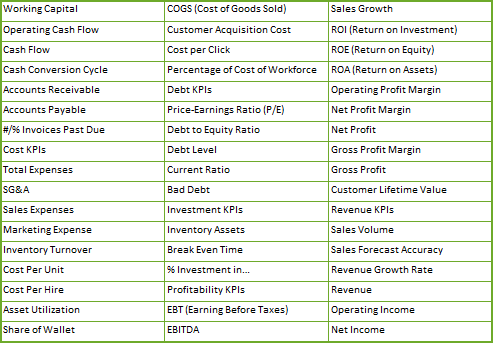

Know your company’s and your customers' goals. There are different types of KPIs, or key performance indicators, for some companies - most often for their financials - but, for a truly comprehensive analysis and strategy, you'll want to look at multiple KPIs.

Looking into the overall corporate scorecard is an essential step in developing overall strategies for your categories. For instance, what are your shopper KPIs? And for retail clients, or if you're a category manager for a retailer, what are the category-related KPIs? Without looking beyond financial KPIs, you're really going to have a difficult time understanding what's an insight and what's not. Some resources you can access for creating additional KPIs are the annual reports, news articles, asking other people, and talking to your manager. Again, it’s imperative for you to build your business acumen and understand strategically what you're trying to accomplish and how you're going to get there, either for your company or for your customers. Because if you're doing analytics at your desk - and no matter how good of an analyst you are - if you don't understand the overarching strategies of what you're trying to accomplish, you're just point blank not going to draw the correct insights from it.

Once you understand your goals and strategies and are working at your desk on a category assessment you can start finding some really great insights to suggest to your retail customer. In a retail customer example, opportunities may include increased market share in the premium segment, gross sales by a certain percentage, increased shopper loyalty with millennials, or increased dollars spent per buyer. Then say you share these opportunities with your retail category manager or, if you're the category manager, somebody comes in and says let's increase market share in the premium segment because you're less developed than you could or should be, what are you still missing?

The strategy!

I see this so many times — people come up with interesting insights but they're not sure if they're relevant for the category or for their retail customer; it might even go against what they're trying to accomplish, but they don't realize it because they're not basing the insights on strategic foundations.

To create strategy, you need a few things. One is well-defined category management foundations; once you have that, you can apply your solid understanding of those foundations to your categories and create a roadmap of where you need to go. This includes overarching retailer and supplier strategies, category definition and segmentation, as well as category roles and strategies.

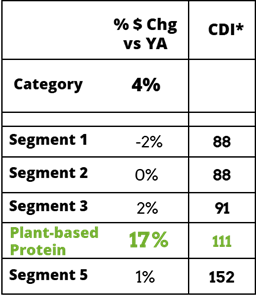

The second part of strategy relates to your insights, which should be derived from those overarching category management foundations. As an example, say I identified that there's rapid growth in a specific segment in a category — maybe it's plant-based proteins in the pasta category. When I do a bit more digging into the details, I might identify that even though the retailer is already highly developed in this segment, there's still an opportunity for them to grab more shares. And when I dig more deeply, I see that some new listings and promotions could really help them, and I have the numbers to prove it.

In this chart, you see the category is up 4%. You can also see the different segments and that plant-based protein is up 17%. Even though they're already more highly developed in the plant-based protein segment than in some of the other segments, there’s still an opportunity for them to grow further and even grab more share.

After you have your category plan, the next step is to go deeper. Make sure you include the shopper. (If you use those category management foundations properly, the shopper is already baked into your overall category management foundations.) Have the strategies tied in with your category plan so it's not just tactical, but so there are actually strategies, as in the example above, to make your plan really compelling.

Now we have a solid crust of pizza. It's baked with goals and strategies for solid foundations that's going to hold your pie together. We’re also going to make sure that you focus on the right ingredients to put on top of it to get your pizza right. This is where relevant insights come into play.

The Right Toppings — Relevant Insights

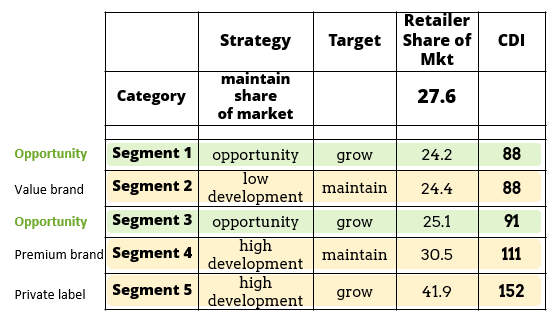

With relevant insights you can go beyond just the numbers and provide the retailer with strategic feedback. Using the same plant-based protein example as above, when looking at their categories you’ll see certain segments have lower percentages than others and are less developed. However, telling them they should be pulling back on over-developed areas and focusing on the lower-percentage segments to help develop them more would be short-sighted. That is simply looking at the numbers without insight or understanding why.

For instance, Imagine if one highly-developed segment was actually their private label segment and is obviously very important and highly profitable for them. If you're going in and making recommendations to be pulling back on that, unless you have specific proof to show that this is not beneficial for them, you don't want to be going down that street because private label is a very, very important strategic component for retailers.

By having some targets associated with their categories and applying the strategies behind those different pieces, you really do end up with a much more strategic approach that's not just numbers — erasing the thinking that below 100 is not good and we need to increase development there and, oh, if it's over 100 we've got to cut back on support or listings. You won’t get very far with the retailer by basing your recommendations on numbers alone without relevant insight.

So now we have some great toppings to go on the pizza — more focus on the measures that are relevant based on your strategy and your goals.

Know your key data sources, make sure you understand them, and make sure you're not just using point of sale data or syndicated POS data. You want to be looking at a robust set of data in order to better understand the business. If you don't feel comfortable with measures or if there's something you don't understand, go look into them to try to find the meaning behind them because it's important to understand what your company is trying to accomplish. By understanding strategically set visions for categories and also understanding your retail customers (if you call on customers), you'll be able to turn your data into insights.

Adding Sauce and Cheese — Creating Scorecards

The last piece is scorecards. Scorecards give you the basis for being able to plan. We understand the overall strategies, we've done the analytics, we've found some relevant insights, and now we want to develop a scorecard for the category.

Your scorecard is not going to look the same as your corporate organizational scorecard; it's just at the category level. It might be from the volume metrics or the financials, so it may be something basic. For example, last year we did 500,000, and this year our target is 550,000, so we need to build our sales by 50,000 and to look at some of the key measures there.

But the ones you really want to make sure you understand are the ones that are going to help you to achieve your plan.

For instance, if I've determined that I want my premium segment share to grow and that's going to be worth a certain number of dollars, I should have the target in there. Then we should be measuring against that to see if we're able to grab that additional market share. Or there might be things like store brand share and average household category dollars per year. Make sure the measures tie in with the assessment insights and strategies so you can create a live scorecard that you feel confident is going to help you to achieve your goals.

The whole pizza now ties in beautifully together. You have your sauce and cheese to pull everything together and allow you to create relevant scorecards for your business based on what you're trying to accomplish. And if you work with retailers, or retailers who are doing these scorecards on their own, make sure that you have access to them so that you understand the whole plan. Then, you can create this beautiful, delicious pizza - your category plan - that will help you to achieve your goals.

Click here to watch the live virtual training on this topic.