When using data and analysis, the numbers on their own don’t tell the whole story. By applying thought and strategy to the interpretation of the data, you will come up with better category solutions. One of my favorite examples of this is the use of the “Retailer Market Share” number in category management. If you’ve ever heard, “You are underdeveloped in a brand, subcategory or category, and you need to fix this!”, then read on …

This demand is based on the interpretation of one of two things:

- Comparison of a Brand or Segment’s Category Share in the market vs at a Retailer; or

- Comparison of a Retailer’s share of market across Brands and Segments within a Category.

In essence, they net the same result: a benchmark for Retailers to understand “development” across brands and segments within a category.

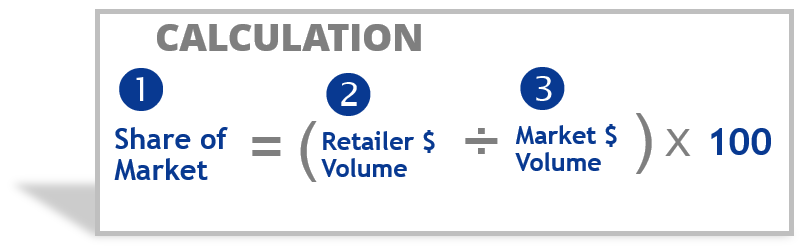

Let’s start with the Retailer Market Share Formula:

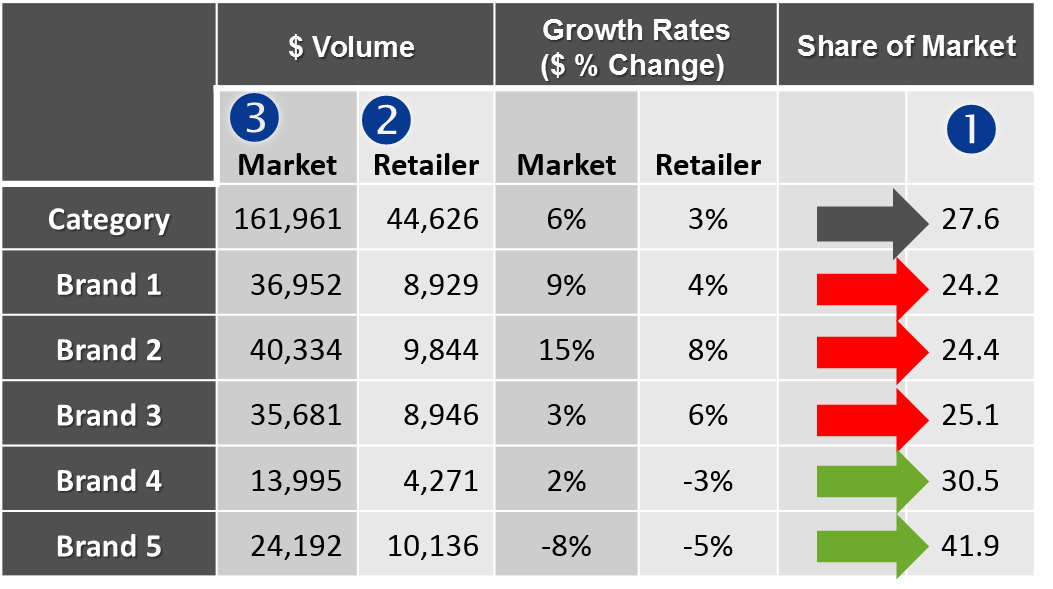

and an example:

Retailer Market Share is an important benchmark that tells the Retailer what percentage of the total market volume that they represent at a category level, as well as at a brand and segment, and even an item level.

In the above example, for total Category, the Retailer’s share of the market is $44,626, divided by $161,961, which equals 27.6.

Let’s review…

This Retailer has a 27.6 share of the category in the market, or in other words, represents 27.6% of the total category dollar sales in the market.

-

Retailer Market Share at a brand level that is lower than total category share represents segments that are under developed, like the ones highlighted with a red arrow above .

-

Retailer Market Share at a brand level that is higher than total category share indicates highly developed brands, like the ones highlighted with a green arrow above.

Now it’s important to properly interpret these numbers. Here’s my take:

- Retailer represents 27.6% of category dollar sales in the market.

- Brands 1, 2 and 3 are the least developed segments (lower share of market than category).

- Brands 4 and 5 are the most developed brands (higher share of market than category).

You’ll note that I didn’t associate an over development on the brands that are most developed, or an under development on the least developed ones. This is because Retailers need to be more strategic (not just relying on numbers above or below market share) to determine their development opportunities for their categories.

Consider the two examples below —

Example #1

If Brand #3 is a value brand that competes directly with their Private Label (Brand #5). The Retailer may strategically be targeting this brand to further develop their own Private Label brand. It’s the same Shopper that both brands are competing for and there’s low loyalty in the value segment. In this instance, they may have a target market share for Brand #3 that is much lower than the category market share.

Example #1

Brand #4 has a higher market share than the category market share. But what if this brand is an organic, fast-growing brand with premium pricing that matches well with the Retailer’s target consumer? They may want to create a target market share of 33 or 34 to meet the needs of their premium consumer and a brand that ties in with their corporate retail strategy, emphasizing health & wellness.

In net, Retailers need to be strategic, at a category level, about which brands and segments they want to be “most” and “least” developed, based on their target consumer and what they are trying to accomplish in the category.

Retailer Market Share is an important measure that Retailers and Suppliers / Manufacturers should understand. Using it as a benchmark, they can create targets to ensure they are achieving their overall objectives, instead of simply gauging whether performance is higher or lower than the category share of the market.

Remember to consider the Retailer’s strategies when drawing conclusions from these numbers. If you’re the Supplier / Manufacturer of Brand #3 in the example above, you are going to have a much more difficult time convincing the Retailer that the biggest opportunity is to increase the market share of Brand #3.

Start to think more strategically about your interpretation of numbers, and ensure that you’re considering the Shopper, Retailer and total category perspective when drawing insights and actions from the category.