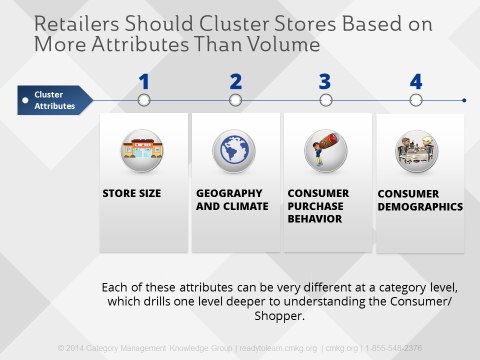

Store clustering is no longer about grouping retail stores based on store size, geography and/or dollar volume.

The first step towards true Shopper marketing is building a new set of strategies for store clusters (groups of stores that have similar Shoppers, performance and traits). Then, for individual stores, assembling the right resources with the right ideas and competencies.

In short, clusters need to be based on Shopper-focused attributes. By understanding the different demographics within local communities where their stores reside, stores can better meet the needs of a larger range of people. This Shopper-focused store cluster approach enables Retailers to quickly identify clusters of stores with similar demand patterns and focus on the most important target segments. Below are 3 steps to build and define Shopper-focused store clusters.

Here are some resources to help you get started:

- Complimentary Download: How to Run Control-Store Testing

- Course Video Preview: Store Clustering Through Store-Level and Geodemographic Data

- Course Overview: Store Clustering Through Store-Level and Geodemographic Data

3 Steps to Shopper-Focused, Retail Store Clusters

-

Define target Shopper groups.

Many Retailers and Vendors continue their focus on the “average Shopper”. When you think about it, does the “average Shopper” even exist? How do you combine demographics like lifestage (single, new family, empty nester), ethnicity, generation (such as the Baby Boomers and Millennials), and/or household income levels to come up with an average Shopper?

Retailers need to clearly identify and understand the specific groups they are targeting so they can properly merchandise, promote and price their categories.

-

Cluster your stores.

The next step is for Retailers to cluster their stores based on the defined target Shopper. This requires Retailers to look at their business in a more specific way. But going all the way down to a store level makes tracking changes unmanageable, especially given all available data sources.

The opportunity? Group stores together so Retailers can target the unique demands of similar local markets and achieve new operational efficiencies.

4 Types of Store Clustering

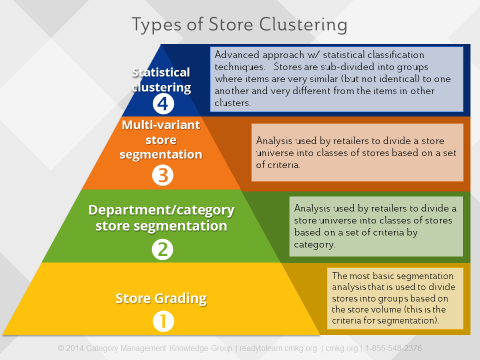

There are many different approaches to the segmentation and clustering of stores – from very basic (store grading) all the way to highly advanced (statistical clustering).

STORE GRADING

Many Retailers already grade their stores – based on store sales, usually by a percent of average sales across all stores. The “A”, “B” and “C” stores are grouped based on stores’ % performance above the “average store”. This is an antiquated way for Retailers to look at their business, because it fails to appreciate the Shopper’s perspective.

DEPARTMENT/CATEGORY STORE SEGMENTATION

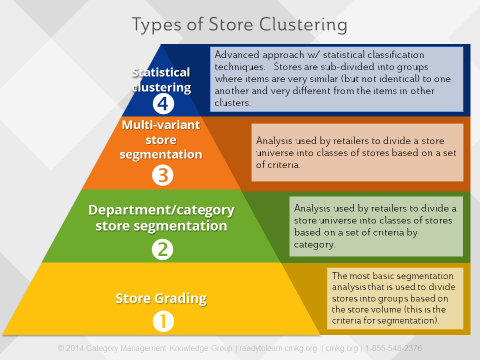

Retailers can move to a more Shopper-focused approach by considering some of the following attributes:

- Store size is a physical attribute that can influence store volume significantly.

- Similar geographic locations and climate conditions can have a big impact on a variety of categories, based on something as simple as the climate within a region.

- Shopper purchase behavior – loyalty can be measured, so a Retailer may want to cluster their most loyal or heaviest-buying Shoppers.

- Attributes based on the Shopper – things like demographics, income, age or ethnicity.

A combination of robust Shopper data provided by the Vendor and a Retailer’s store POS data will help create some basic Shopper clusters.

MULTI-VARIANT STORE SEGMENTATION

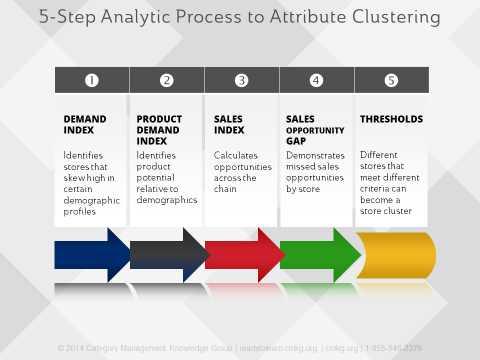

The next step is to follow an analytic process to move to multi-attribute store clustering.

STATISTICAL CLUSTERING

The final, and most advanced, store grouping approach is statistical clustering. Cluster analysis dramatically elevates a Retailer’s understanding of their stores and Shopper needs. It is a statistical classification technique in which retail stores are sub-divided into groups (clusters) such that the stores in the cluster are very similar (but not identical) to one another and very different from the stores in other clusters. There are now data and tools that simplify statistical cluster analysis. SAS Institute, JDA, Infosys, and SAP are just a few names of technology companies that provide these software tools.

-

Analyze store clusters.

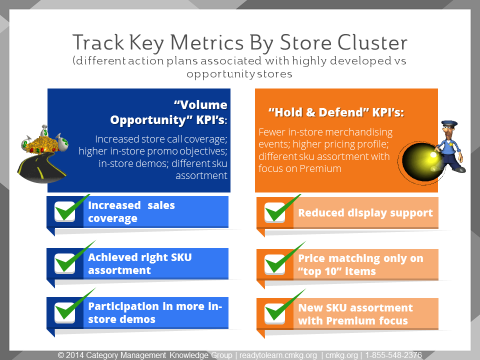

Once clusters have been defined, the new insights and views of the data will help the Retailer make business decisions based on key performance indicators (KPIs). Tracking these KPIs by store cluster gives the ability to apply different performance goals to different store cluster types. For example, a cluster with “volume opportunity” goals will not have the same set of KPIs as a cluster with a “hold & defend” strategy.

This approach to store management by a category manager allows for a focused approach and breaks down the stores in a retail chain by their potential.

Scorecards and reporting should tie in with store clusters and their goals & objectives based on their KPIs. Retailers also need to define how they will market differently to their store clusters through product assortment, shelving, promotion, pricing and in-store/Shopper marketing.

By using segmentation and clustering analysis Retailers are able to create a manageable number of store clusters that are well-differentiated and at the same time homogeneous within the cluster. Retailers can cluster their stores based on a variety of different factors including: consumer sales history, demographic and lifestyle data, product attitudes, competition, store size and store productivity.

There are many benefits to store segmentation and clustering analysis, including:

- Improved store assortment and merchandising through Shopper-centric cluster assortments;

- Development of cluster-specific marketing strategies based on Shopper insights;

- Customized pricing and promotional strategies for each cluster; and

- Increased Sales and Profit through efficiencies and Shopper satisfaction.

Before Retailers can move to this clustering approach, they need to have the data storage requirements, analytical know-how and the right clusters defined for their stores. Once clusters are defined, Retailers should maintain them regularly to reflect the needs of the changing Shopper.

Looking for a strategic approach to Store Clustering and Geodemographics? Category Management Knowledge Group can help you, your team or your organization learn more through a single course or a customized program. We have some great category management training options available to meet your needs.

|

$125 USD 30-day Access Hands-On Downloadable Reference Guide Knowledge Checks Course Test |