Welcome to the exciting world of category management! This is where data transforms into gold for both Retailers and Suppliers/Manufacturers. With heaps of data at our fingertips, there are some key measures you should know about to make the most of it. In this blog I'll be covering the "Index" calculation.

Ever heard of the Category Development Index (CDI) and the Fair Share Index (FSI)? They're some of the superheroes of data analysis. But beware, they're often misunderstood!

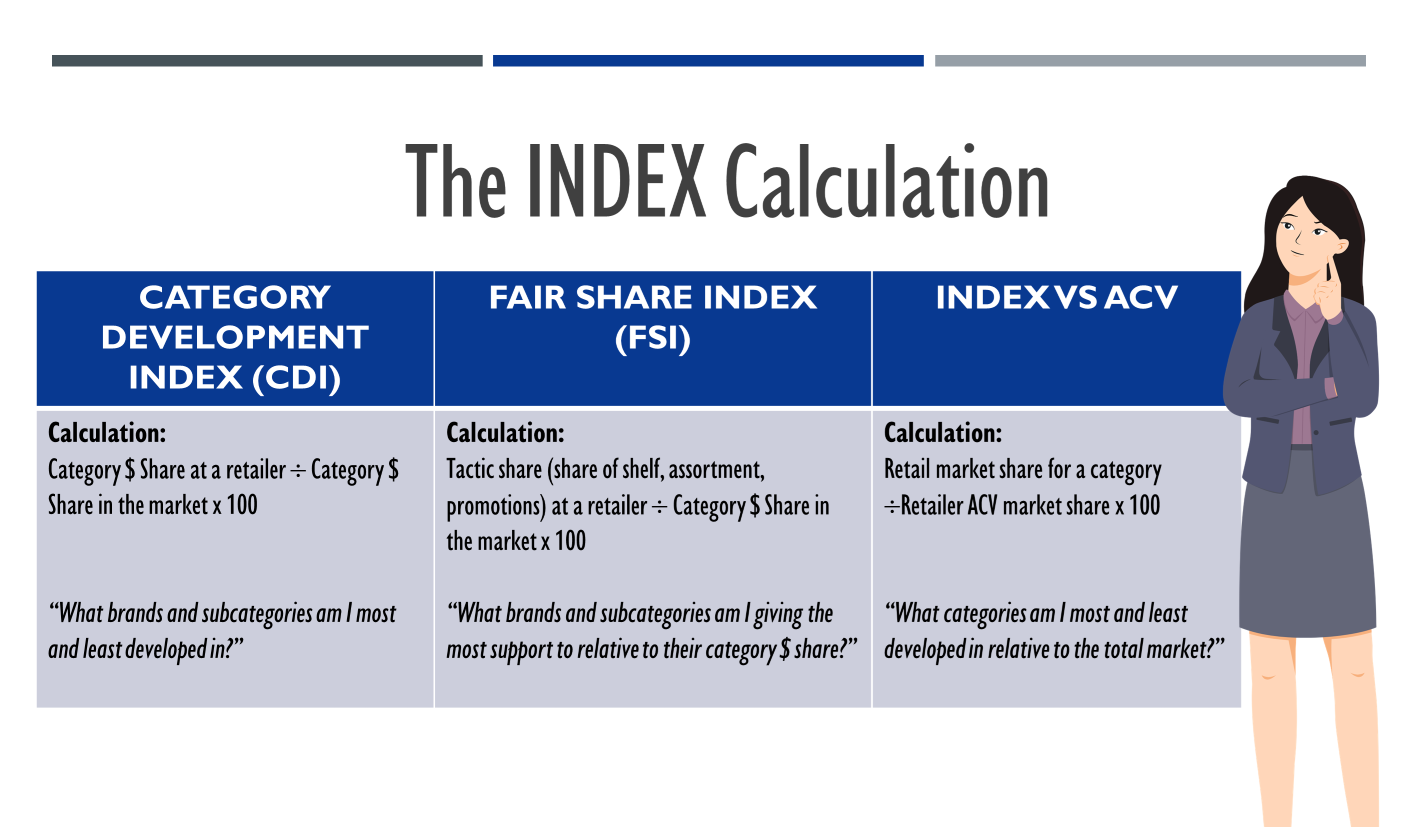

Now, let's break it down. Indices compare things like last year's sales vs. this year's, or your targets vs. what actually happened. They're super handy for understanding your data and can be a helpful benchmark.

But here's the tricky part: interpreting these indices. People often oversimplify, thinking over 100 is always great and under 100 is not so great. The truth is, it's all about context and strategy.

Let's look closer:

- Category Development Index / CDI: It's all about comparing your brand's share at a retailer to its share in the market. But remember, a number over or under 100 doesn't tell the whole story. What's the retailer's game plan? That's what matters. Check out my video below that explain more details about this powerful calculation:

- Fair Share Index / FSI: This one's about measuring how your tactics (like share of shelf, items, promotions or displays) stack up against your category share. Suppliers/Manufacturers, this is crucial for you. Think beyond the number – align with the retailer's big-picture goals. It's important to go beyond simply receiving (or demanding) your "fair share" and instead, strategize and understand why retailers would be willing to give you more than your fair share of a tactic for your brands.

- Index vs ACV Measure: This is a cool way for retailers to see how developed their categories are relative to the total market. However, it's important to remember that numbers alone don't tell the whole story. To truly excel in category management, you must have a strong understanding of your target shoppers and develop strategies that align with their needs. This means prioritizing certain categories over others based on your shoppers' preferences. Take the time to analyze your competition and consider how you can outperform them. It's not just about the numbers, but about creating a comprehensive and effective category strategy that sets you apart from the rest.

So, what's the takeaway?

- For Retailers: Forget the standard '100' benchmark. And don't allow your suppliers to persuade you that aiming for indices of 100 for all the brands you carry is the ultimate goal. Set your own goals that mesh with your shopper strategies and category targets.

- For Suppliers/Manufacturers: Focus less on what you're not getting and more on why a retailer should boost your brands with the data to back it up. This can be determined by the value your brands bring to the retailer's desired customer base, the evolving shopping trends, or other valuable insights about the category that you can extract from the data.

Need more information on the subject? Don't worry, we've got some cool tools to help you get it right:

- Grab our eye-catching infographic to see CDI and FSI in action.

- Dive into our dynamic training courses, available at CMKG.

I trust that this blog post has provided you with valuable insights into the crucial "Index" calculation. It is essential to go beyond the surface-level numbers and embrace strategic thinking, incorporating your expertise in strategy and category knowledge. Utilize these indices to propel your business forward in innovative and impactful ways. Let's turn data into your superpower! 🌟📊

Happy learning! Sue