Learn how to build strategic thinking into your analysis to understand more advanced Shopper solutions

I’ve been writing and speaking about the components of category management which relate directly to the Category Management Association’s certification requirements, including:

- Steps of the category management process and the importance of Retailer strategy;

- Key data sources available and the different data insights to uncover;

- Drilling through data (including in a limited data environment) to discover strategic insights; and

- Assessing the health of your business.

The opportunity? Think outside the box, incorporate strategy into your choices and recommendations, dig deeper only when necessary and tie in insights and opportunities with action through the category tactics. Once you've done this, the next step is to move to more advanced category analytics, including dimensionalizing business driver results from a threshold perspective and predictive analytics.

Here are some resources to help you move to more advanced analytics:

- Complimentary Download: Analyzing Key Business Drivers Through Thresholds

- Course Video Preview: Advanced Analytics: Relativity

- Course Overview: Advanced Analytics: Relativity

8 Ways to Move to More Advanced Category Management Analytics

1. Start “higher” in your analysis:

- Who’s growing and declining?

- How does this compare to your region and channels?

- And how does the Retailer / banners compare to these results?

2. Drill down for better insights:

Drilling through data gives you a broader perspective of your business results.

- Look at more than one time period (at least one long-term and one short-term period, for example “latest 52 weeks” and “latest 12 weeks”) to understand short- and long-term trends.

- Look across different segments based on the consumer decision tree to consider the Consumer or Shopper in your analysis.

- Look across different data measures to consider volumetric and share results as well as tactical results and trends. Click here to see a video on drilling through data.

3. Don’t be linear in your analysis:

When completing analysis, use multiple data sources: Retailer point of sale data (syndicated market data, market gap opportunities, comparison vs market); Consumer panel data (consumer demographics, consumer purchase behavior, heavy / light buyers). We’re taught how to pull and use each data source in isolation with more of a tactical approach to the data. The opportunity is to learn how to look across data sources and incorporate insights from one source to help you make better decisions in business issues or opportunities that you are trying understand. This will take you from “good” to “great” (or even “amazing!”) in your analysis and insights. My Tip #8 below can help you with this.

4. Don’t generalize what your numbers mean:

Think beyond a number. If you tie in with strategy or find relevant benchmarks to compare against or create volume opportunities, the numbers can become much more meaningful. Here are some examples:- When using a fair share index, don’t assume it’s “good” or “bad” based on if it’s above or below 100. Think about how the index relates to the goals and objectives for the category, target Shopper and overall Retailer strategies. Click here to learn more about Fair Share Index.

- When using consumer purchase behavior, compare to numbers that help establish benchmarks to determine where the opportunities are. You'll only know if a penetration or share of requirements measure is “high” or “low” by comparing with other Retailers in the same category or comparing to related categories.

RETAILER ONLY

5. Incorporate Retailer strategy and Shopper into your analysis:

Retailers need well-developed strategies that relate to their store formats, the tactics, Private Label and their target Shopper. They need to incorporate these overarching strategies into their category decisions, including data analysis, insights and decisions for their categories. The strategies give a Retailer the guidelines, principles and processes associated with the most important elements of their strategy. It helps your retail teams make the best decisions for their categories based on what the Retailer is trying to accomplish. The better articulated the strategies, the better and more aligned the decision making for your retail organization.

VENDOR ONLY

6. Think “category” and “brand”:

7. Incorporate Retailer strategy and Shopper into your analysis:

Don't forget the Retailer's strategy and their unique Shopper when you are completing any type of analysis for them and making fact-based recommendations. Whether you're creating an assortment analysis, doing shelving work, creating a pricing analysis or setting up promotions for next year, remember to check back to their target Shopper and overarching strategies to make sure that the recommendations you're making match well with what they're trying to accompish.

ADVANCED CATEGORY ANALYTICS

8. Use thresholds in your analysis:

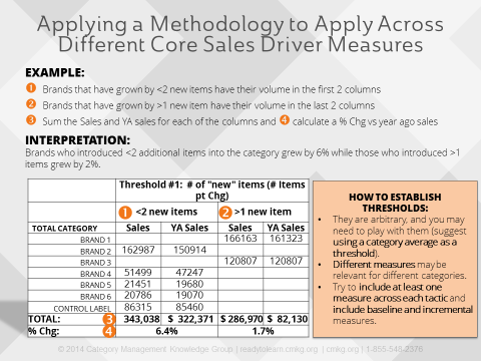

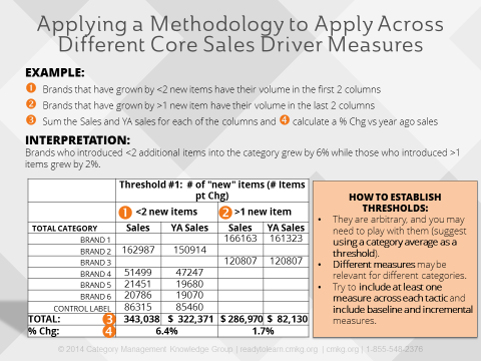

My example above includes some data measures related to product availability, or sku efficiency, for a specific Retailer. Any brands that have grown by less than 2 new items over the time period have their volume under the first two columns for this year and last year sales. Any brands that have grown by more than 1 item over the time period have their volume under the last two columns. Next, I sum the brand volume for each of the different thresholds and compare their growth.

So in this example, brands who brought in less than 2 additional items into the category grew by 6%, and those who brought in 2 or more items grew by 2%. The thresholds that you assign are arbitrary – in this example, those sku’s with less than 2 or more than 1 items. You may need to play with these thresholds or use the category average as the threshold.

Also, different measures may be relevant for different categories. You should include at least one measure across each of product availability, pricing and promotion, also including baseline and incremental measures.

Looking to move to more advanced analytics? Category Management Knowledge Group can help you, your team or your organization learn more through a single course or a customized program. We have some great category management training options available to meet your needs.

Check out our accredited course on Advanced Analytics: Relativity or watch a video preview of the course by clicking the graphic below.

|

$125 USD 30-day Access Hands-On Downloadable Reference Guide Knowledge Checks Course Test |